When deciding between leasing and buying equipment, conduct a detailed cost analysis weighing leasing benefits (flexibility, lower upfront costs, favorable tax deductions) against buying advantages (long-term asset ownership, potential tax breaks through depreciation). Tax considerations are crucial: leasing offers immediate savings through deductible lease payments, while buying involves gradual depreciation. The best strategy optimizes financial stability, cash flow management, and future asset utilization based on individual business needs and financial health.

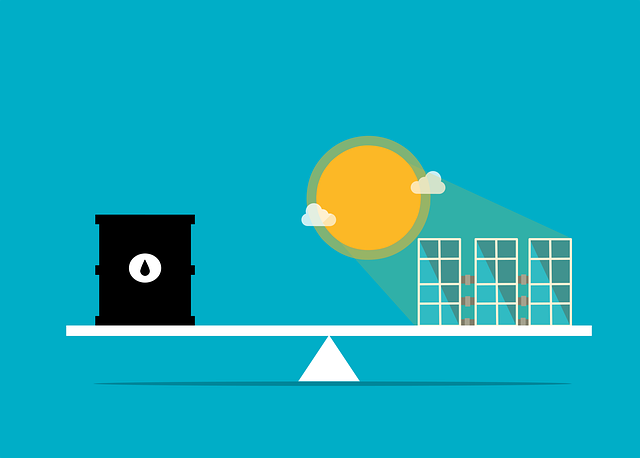

In today’s dynamic business landscape, organizations often grapple with the decision between leasing and buying equipment. This article delves into the intricate balance between these two financial strategies, offering a comprehensive cost analysis that compares leasing vs. buying. We explore key leasing benefits, such as flexibility and cash flow management, while also highlighting buying advantages like building asset ownership and long-term savings. Additionally, we navigate tax considerations and delve into the financial implications of short-term vs. long-term expenses. Ultimately, understanding these factors is crucial for making informed decisions and optimizing asset ownership.

- Cost Analysis: Leasing vs Buying Equipment

- Leasing Benefits: Flexibility and Cash Flow Management

- Buying Advantages: Building Asset Ownership and Long-term Savings

- Tax Considerations: Deductions and Potential Savings

- Financial Implications: Short-term vs Long-term Expenses

- Asset Ownership: The Final Decision and Future Planning

Cost Analysis: Leasing vs Buying Equipment

When considering whether to lease or buy equipment, a thorough cost analysis is imperative. Leasing offers distinct benefits from a financial perspective. Initially, it can reduce cash outlay since you pay for the equipment over time rather than in full at once. This is especially advantageous for businesses with limited capital or those anticipating future changes in technology. Furthermore, many leasing agreements offer tax advantages; the costs associated with leasing are often deductible, which can lower your overall tax burden.

Conversely, buying equipment provides long-term asset ownership, allowing you to build equity and potentially sell or trade assets later. However, this route often involves significant upfront costs, substantial maintenance expenses, and limited flexibility to adapt quickly to changing business needs due to the financial commitment. Therefore, a cost analysis should weigh the immediate financial implications of each option, considering tax considerations and the long-term impact on cash flow and asset management strategies.

Leasing Benefits: Flexibility and Cash Flow Management

Leasing offers significant advantages for businesses, especially in terms of flexibility and cash flow management. Instead of a one-time substantial investment in purchasing equipment, leasing allows companies to spread out payments over an agreed-upon period. This approach provides a thorough cost analysis, helping businesses allocate financial resources more effectively. By leasing, companies can access modern, high-performance equipment without the immediate burden of asset ownership.

From a tax perspective, leasing can have favorable financial implications. Lease payments are often deductible as business expenses, offering potential tax savings. Moreover, lessees do not incur depreciation costs associated with owning assets, as the equipment remains the lender’s property. This approach enables businesses to focus on their core operations rather than managing physical assets, thereby enhancing overall efficiency and flexibility in decision-making processes.

Buying Advantages: Building Asset Ownership and Long-term Savings

When considering whether to lease or buy equipment, a critical aspect often overlooked is the buying advantages, particularly the benefits that accrue over time in terms of asset ownership and long-term savings. Leasing offers flexibility and immediate access to necessary tools and machinery, but buying presents a different set of financial and strategic advantages.

One significant buying advantage is the potential for substantial long-term savings. While initial purchasing costs may be higher than monthly lease payments, over time, owning equipment can result in considerable financial benefits due to the absence of recurring rental fees. Additionally, there are tax considerations that favor ownership; depreciation of assets can offer tax breaks, offsetting some of the upfront expenditure. This cost analysis should factor in not just the immediate financial implications but also the future financial health and stability it contributes to through building asset ownership.

Tax Considerations: Deductions and Potential Savings

When considering leasing equipment versus purchasing, a key aspect to evaluate is the tax considerations. Leasing offers unique advantages that can significantly impact your financial implications. One of the primary benefits is the potential for substantial deductions on your tax returns. Many lease payments are treated as business expenses, allowing businesses to reduce their taxable income. This can result in immediate savings and even a tax refund, especially if depreciation costs are also factored in.

While purchasing equipment provides asset ownership, it typically means depreciating the value of those assets over time, which can limit tax deductions. Leasing eliminates this concern as you’re not acquiring ownership. A cost analysis should weigh these factors: while initial outlay for purchasing might be lower, the long-term financial benefits of leasing, including potential savings on taxes and flexibility to upgrade equipment, cannot be overlooked.

Financial Implications: Short-term vs Long-term Expenses

When considering equipment leasing, a crucial aspect to evaluate is the financial implications, particularly when contrasting short-term and long-term expenses. Leasing offers flexible cost analysis by distributing expenses over time, which can be advantageous for businesses with fluctuating cash flows or those seeking to avoid significant upfront investments. This approach enables access to modern equipment without committing to its full purchase price, a benefit especially appealing in industries where technology rapidly evolves.

However, long-term leasing might result in higher overall costs compared to buying equipment outright. While initial outlays for purchasing are substantial, they typically provide more permanent asset ownership and eliminate recurring lease payments. A thorough cost analysis should factor in tax considerations; lease payments may be tax-deductible, whereas there’s no such advantage with a purchase. This distinction can significantly impact the financial bottom line, especially for businesses aiming to optimize their tax strategies.

Asset Ownership: The Final Decision and Future Planning

When deciding between leasing and buying equipment, one crucial aspect to consider is long-term asset ownership. While leasing offers immediate access to necessary tools and machinery with minimal upfront costs, it ultimately means giving up ownership. This can be a significant drawback for businesses aiming for long-term strategic planning.

On the other hand, buying equipment provides full asset ownership, offering more flexibility in terms of modifications and future reselling or repurposing. A thorough cost analysis should weigh the financial implications of each option, including buying advantages like potential tax benefits related to depreciation and amortization. Ultimately, the decision should align with the company’s financial health, goals, and future plans for equipment utilization.