When deciding between lease agreements and purchase contracts, consider upfront costs, long-term financial goals, tax benefits (like depreciation for buying), and individual needs. Leasing offers lower initial expenses, flexibility, and potential tax deductions but doesn't build asset ownership. Buying involves significant upfront costs but provides immediate ownership, future savings from avoided rent, and potential tax advantages like deductions for property taxes and mortgage interest. The best choice depends on your budget, desired control over assets, and long-term financial strategies, with both leasing benefits and buying advantages having distinct financial implications.

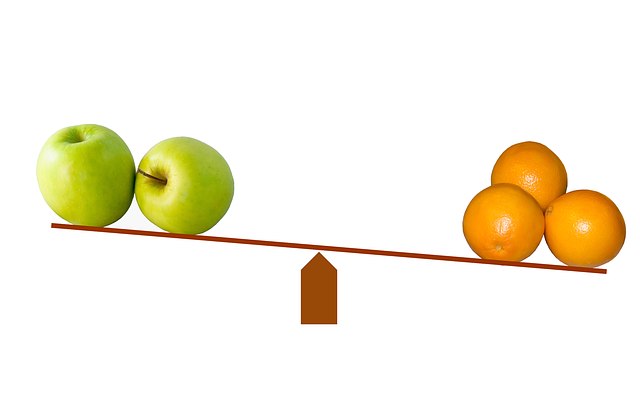

Lease agreements versus purchase contracts present pivotal decisions for individuals and businesses alike. This article delves into the intricate differences between these two options, offering a comprehensive guide for informed decision-making. Through a meticulous cost analysis, we compare upfront expenses, from security deposits to applicable fees. We explore the flexibility of leasing and its short-term advantages, contrasting them with the long-term savings and asset ownership that purchasing offers. Tax considerations, financial implications, and the broader theme of asset ownership are also dissected, providing insights crucial for navigating this pivotal choice.

- Cost Analysis: Comparing Upfront Expenses

- – Break down initial costs for leasing vs. purchasing

- – Include security deposits, first month's rent/payment, and any applicable fees

- Leasing Benefits: Flexibility & Short-Term Advantages

- – Discuss the benefits of short-term commitments

- – Highlight options to upgrade or change space without long-term obligations

Cost Analysis: Comparing Upfront Expenses

When weighing lease agreements versus purchase contracts, a critical factor to consider is the cost analysis—specifically, comparing upfront expenses. Leasing offers several financial benefits that can be appealing for businesses and individuals alike. Initially, leasing typically requires lower upfront costs since you’re not buying the asset outright. This can free up capital that would otherwise be tied up in a large purchase, enabling you to invest in other areas of your business or personal projects.

On the other hand, purchasing an asset comes with significant upfront expenses, including the cost of acquisition and any necessary repairs or renovations. However, owning an asset provides long-term financial advantages such as avoiding lease renewal costs and potential rent increases. Additionally, there are tax considerations to keep in mind: depreciation for purchased assets can offer tax benefits over time, while leases generally do not provide the same level of tax advantage. Ultimately, the choice between leasing and purchasing depends on your financial goals, budget, and the strategic value of owning versus renting an asset.

– Break down initial costs for leasing vs. purchasing

When considering lease agreements versus purchase contracts, a thorough cost analysis is essential to understanding the financial implications for businesses and individuals alike. Initial costs play a significant role in this decision-making process. Leasing typically involves lower upfront expenses as tenants often only pay for the depreciation of the asset over time. This can be particularly advantageous when cash flow is limited or funds are allocated towards other strategic investments. On the contrary, purchasing an asset through a contract demands a substantial down payment, followed by regular repayments. While this provides immediate asset ownership, it requires significant capital outlay at the beginning.

From a tax perspective, leasing offers certain benefits that can help mitigate financial burdens. Lease payments are often tax-deductible, and businesses may even be able to write off depreciation expenses. In contrast, buying an asset usually results in higher taxable income due to the cost of acquisition and subsequent maintenance or repairs. However, owning an asset allows for potential long-term savings as future lease payments can be avoided once the loan is repaid. The choice between leasing and purchasing depends on individual circumstances, including budget, tax considerations, and desired level of control over the asset, ultimately shaping financial strategies and business operations.

– Include security deposits, first month's rent/payment, and any applicable fees

When considering lease agreements versus purchase contracts, a key aspect to evaluate is the initial and ongoing financial commitments. A lease often requires a security deposit, which acts as a guarantee for the landlord against potential damages or unpaid rent. This deposit is typically returned at the end of the lease term, assuming no issues. In contrast, a purchase contract demands a larger upfront payment, encompassing the first month’s rent or payment, and may include various fees like processing or application charges. While this initial cost can be higher with purchasing, it eliminates the need for regular rent payments, offering long-term financial stability and the benefit of building asset ownership.

The financial implications extend beyond the immediate costs. Leasing provides flexibility as monthly payments are usually fixed and predictable, making budgeting easier. However, over time, these payments do not contribute to asset ownership. Conversely, buying comes with significant tax considerations; property taxes and mortgage interest may be deductible, reducing overall living expenses. Additionally, owning a home can lead to substantial savings through equity buildup, which is a key advantage for long-term financial planning and asset accumulation, offering both leasing and buying distinct advantages based on individual circumstances and financial goals.

Leasing Benefits: Flexibility & Short-Term Advantages

Leasing offers a range of benefits that can be particularly advantageous for businesses and individuals with short-term needs or those seeking flexibility in their operations. One of the key leasing benefits is flexibility. It allows tenants to adjust their space requirements easily, whether it’s expanding or downsizing. This adaptability is especially valuable in dynamic industries where market conditions can change rapidly. Moreover, short-term advantages are a significant draw for many. Leasing eliminates the need for a substantial upfront investment, making it easier to enter new markets or secure temporary spaces without committing to long-term financial implications.

When conducting a cost analysis, it’s crucial to consider both the immediate and long-term tax considerations and financial implications. While leasing doesn’t confer asset ownership, it can offer tax benefits, such as deducting lease payments and certain operating expenses. In contrast, purchasing property typically results in significant upfront costs and ongoing maintenance responsibilities, which may not align with everyone’s financial goals or business strategies.

– Discuss the benefits of short-term commitments

Lease agreements offer a compelling alternative to purchasing property, especially for businesses or individuals with short-term needs or uncertain future plans. One of the primary benefits is the flexibility they provide in terms of commitment duration and financial obligations. Unlike purchase contracts that typically require significant upfront costs and long-term financial responsibility, leases often involve smaller, predictable monthly payments over a specified period. This allows for better cash flow management as expenses are spread out, enabling businesses to allocate resources more effectively.

From a tax perspective, leasing can also have advantages. For instance, lease payments may be deductible as business operating expenses, potentially reducing taxable income. Additionally, with leasing, there’s no need to worry about the significant financial implications of asset ownership, such as maintenance costs, repairs, or property taxes. This cost analysis makes it an attractive option for those seeking to minimise long-term financial burdens while still gaining access to necessary assets.

– Highlight options to upgrade or change space without long-term obligations

When considering lease agreements versus purchase contracts, one key advantage of leasing is the flexibility it offers to upgrade or change your space. This option allows businesses to stay agile and adapt to changing market conditions or growth needs without the long-term financial obligations associated with ownership. Leasing provides a cost analysis that can be more manageable, as rent is typically structured to cover property maintenance and taxes, leaving operating expenses more predictable.

Additionally, leasing comes with significant tax considerations; lease payments are often deductible as business expenses, which can result in substantial savings. In contrast, purchasing a property involves a one-time large financial outlay or a long-term mortgage, with fewer immediate tax benefits. While buying an asset confers ownership and the potential for long-term equity, it also carries financial implications like property maintenance costs and the risk of market fluctuations that can affect resale value.